Ct Luxury Car Sales Tax . In addition to taxes, car purchases in. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. Effective july 1, 2011, certain motor. The current sales tax in connecticut is 6.35% for vehicles that are. This includes a 7.35% rate. Web how much is the car sales tax in connecticut? Web register your vehicle for the first time. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. Include sales tax info and purchase price on ct's application for registration and title. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state.

from abbypage.z19.web.core.windows.net

Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. In addition to taxes, car purchases in. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. This includes a 7.35% rate. Web register your vehicle for the first time. The current sales tax in connecticut is 6.35% for vehicles that are. Web how much is the car sales tax in connecticut? Effective july 1, 2011, certain motor.

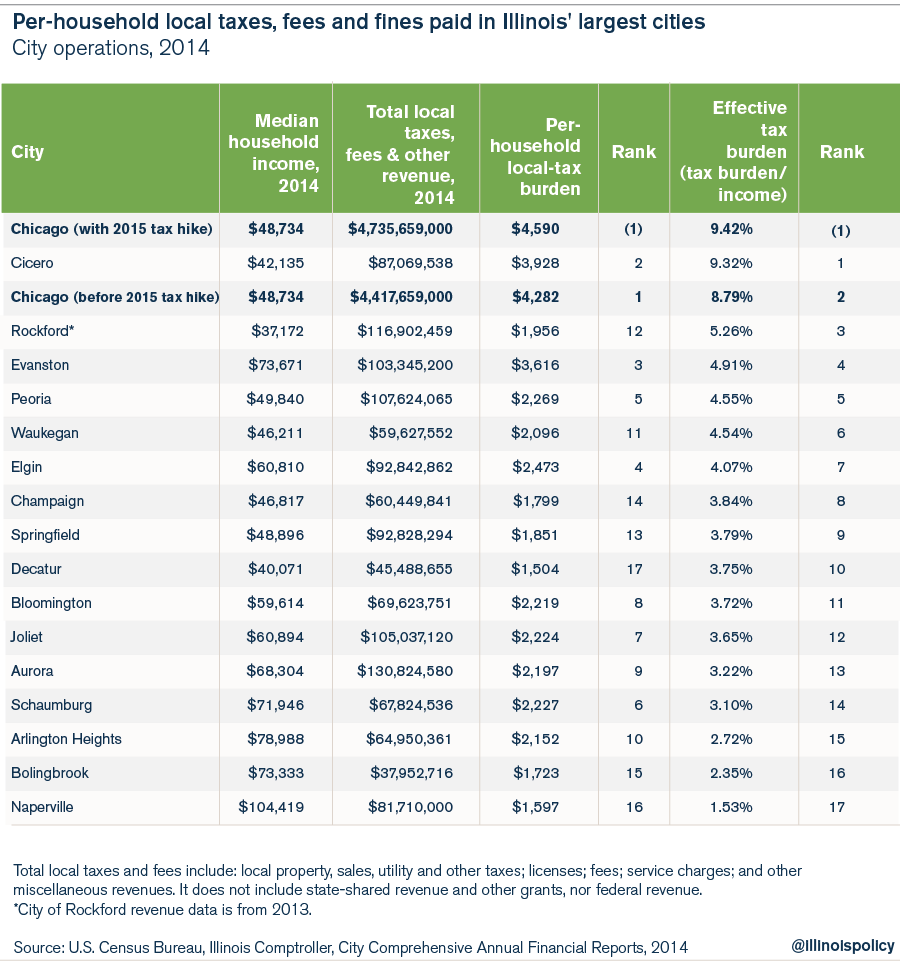

Illinois Vehicle Tax Chart

Ct Luxury Car Sales Tax Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. This includes a 7.35% rate. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. Web register your vehicle for the first time. Effective july 1, 2011, certain motor. The current sales tax in connecticut is 6.35% for vehicles that are. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. In addition to taxes, car purchases in. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Web how much is the car sales tax in connecticut? Include sales tax info and purchase price on ct's application for registration and title.

From breezecustoms.com

Canada's Luxury Tax on Imported Vehicles Breeze Customs Ct Luxury Car Sales Tax Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general. Ct Luxury Car Sales Tax.

From mavink.com

Ct Motor Vehicle Bill Of Sale Form Printable Ct Luxury Car Sales Tax In addition to taxes, car purchases in. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Effective july 1, 2011, certain motor. The current sales tax in connecticut is 6.35% for vehicles that are. Include sales tax info and purchase price on ct's application for registration and title. Web knowing. Ct Luxury Car Sales Tax.

From www.datapandas.org

Car Sales Tax By State 2024 Ct Luxury Car Sales Tax Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. This includes a 7.35% rate. Include sales tax info and purchase price on ct's application for registration and title. Web register your vehicle for the first time. Web. Ct Luxury Car Sales Tax.

From www.craiyon.com

Lexus ct luxury car on Craiyon Ct Luxury Car Sales Tax Web register your vehicle for the first time. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. In addition to taxes, car purchases in. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. Web connecticut collects a. Ct Luxury Car Sales Tax.

From www.nbcconnecticut.com

Deadline to File Taxes is Tuesday NBC Connecticut Ct Luxury Car Sales Tax Include sales tax info and purchase price on ct's application for registration and title. In addition to taxes, car purchases in. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web how much is the car sales tax in connecticut? Effective july 1, 2011, certain motor. Web connecticut collects a 6% state. Ct Luxury Car Sales Tax.

From www.ft.lk

Luxury tax to make car prices exorbitant Daily FT Ct Luxury Car Sales Tax This includes a 7.35% rate. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Include sales tax info and purchase price on ct's application for registration and title. Effective july 1, 2011,. Ct Luxury Car Sales Tax.

From www.youtube.com

TCSLC Vehicle Sales Tax YouTube Ct Luxury Car Sales Tax Effective july 1, 2011, certain motor. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. Web register your vehicle for the first time. In addition to taxes, car purchases in. Web knowing connecticut's sales tax on cars. Ct Luxury Car Sales Tax.

From mungfali.com

6 Percent Sales Tax Chart Ct Luxury Car Sales Tax Web how much is the car sales tax in connecticut? Effective july 1, 2011, certain motor. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. Web connecticut collects a 6% state sales tax rate on the purchase of all vehicles. This includes a 7.35% rate.. Ct Luxury Car Sales Tax.

From abbypage.z19.web.core.windows.net

Illinois Vehicle Tax Chart Ct Luxury Car Sales Tax Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. The current sales tax in connecticut is 6.35% for vehicles that are. Effective july 1, 2011, certain motor. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state.. Ct Luxury Car Sales Tax.

From www.pinterest.com

Pin on Sales Tax Ct Luxury Car Sales Tax Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Include sales tax info and purchase price on ct's application for registration and title. Effective july 1, 2011, certain motor. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web connecticut collects a. Ct Luxury Car Sales Tax.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank Ct Luxury Car Sales Tax Effective july 1, 2011, certain motor. This includes a 7.35% rate. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. The current sales tax in connecticut is 6.35% for vehicles that are. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web. Ct Luxury Car Sales Tax.

From www.factorywarrantylist.com

Connecticut Car Tax Calculator 50,000 at 6.35 or 7.75 Ct Luxury Car Sales Tax Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. In addition to taxes, car purchases in. Effective july 1, 2011, certain motor. Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. Web register your vehicle. Ct Luxury Car Sales Tax.

From wisevoter.com

Car Sales Tax by State 2023 Wisevoter Ct Luxury Car Sales Tax Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web register your vehicle for the first time. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in. Ct Luxury Car Sales Tax.

From sherrillbozeman.blogspot.com

kansas automobile sales tax calculator Sherrill Bozeman Ct Luxury Car Sales Tax In addition to taxes, car purchases in. This includes a 7.35% rate. The current sales tax in connecticut is 6.35% for vehicles that are. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Include sales tax info and purchase price on ct's application for registration and title. Web however, as table. Ct Luxury Car Sales Tax.

From mytaxdaily.com.au

Luxury Car Tax (LCT) In Australia Threshold Increased 2024 My Tax Daily Ct Luxury Car Sales Tax Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. This includes a 7.35% rate. The current sales tax in connecticut is 6.35% for vehicles that are. Web connecticut collects a 6% state sales. Ct Luxury Car Sales Tax.

From revistaliterariasegovia.blogspot.com

Maryland Car Sales Tax Out Of State / Tcslc Vehicle Sales Tax Youtube Ct Luxury Car Sales Tax Include sales tax info and purchase price on ct's application for registration and title. Effective july 1, 2011, certain motor. Web register your vehicle for the first time. The current sales tax in connecticut is 6.35% for vehicles that are. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web. Ct Luxury Car Sales Tax.

From bobatoo.co.uk

A Complete Guide to UK Car Tax Car Tax Explained Bobatoo Ct Luxury Car Sales Tax Web connecticut’s luxury tax is a 7.75% sales and use tax rate that applies to specified items in lieu of the 6.35% general rate. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Web effective july 1, 2011, the general sales and use tax rate increases from 6% to 6.35%. Web. Ct Luxury Car Sales Tax.

From leonardbuteablog.blogspot.com

california luxury tax on cars Connecticut luxury tax on cars Ct Luxury Car Sales Tax The current sales tax in connecticut is 6.35% for vehicles that are. Web register your vehicle for the first time. Web knowing connecticut's sales tax on cars is useful for when you're buying a vehicle in the state. Web however, as table 1 shows, eight other sales and use tax rates apply to specified goods and services. Web how much. Ct Luxury Car Sales Tax.